The Demand

Fine wine matures once bottled, and improves with age. A limited amount is produced every year and as bottles are consumed the supply of the wine becomes smaller. As supply diminishes, demand generally rises as the wine matures. Moreover, demand and interest in fine wine is growing around the world and supply of the top wines cannot be increased. You are investing in a tangible, improving asset that has a limited production but a huge global demand base. The supply of this already limited asset then declines over the years as the wines are consumed.

Demand in Fine Wines has been growing annually as more investment minded people become aware of the opportunities brought about by simple supply and demand. Investment in top class fine wines from the Bordeaux region have shown greater returns and less volatility than any other recognised market.

Fine Wine Demand Explained:

Appellation Controlee

A French phrase, which indicates the wine to which it is applied, has been produced under the strict supervision of the Institut D'Appellations d'Origine, and has been made from grapes grown in a specific area of France. The first Appellation was set up in 1936 in Châteauneuf-du-Pape. Since then the system has been extended throughout France and now covers some 30% of total wine production, including the wines made in the west.

The Institut d'Appellations d'Origine will initially measure and define the area to be included in the particular Appellation and thereafter has authority under French law, reinforced by EEC directives, to regulate the grape varieties that may be planted, the maximum amount of grapes produced, the method of pruning, and often the precise wine-making techniques to be employed.

The Objects of the system are:- To maintain and enhance quality and to maintain the special characteristics of the wines of a particular area. Wine produced under the authority of the Institut d'Appellations dOrigine are entitled to display the term "Appellation Contrôlée" on their bottle labels as an indication that the contents is wine of the best quality and from

a limited supply.

They also limit the amount of labels each vineyard is allocated to only enough for 177 cases of wine per acre of land, for each vintage. Any wine that may be left over after all the 'labelled' bottles are full is sold under a secondary label, or blended with another wine.

Age and Quality

As soon as the wine is ready to drink stocks start to diminish. Wines good enough to be used as an investment will usually have a life span of 40 to 49 years, some may last even longer. An excellent wine will take approximately 5 to 7 years (average) before it has matured enough to be drinkable, however most connoisseurs will wait until the wine has reached its optimum drinkable level, usually when the wine is approximately 12 to 18 years old. The wine will then carry on maturing in the bottle getting better and better as the years pass, right up until the end of its life when it will quite suddenly, (in comparison to its life span) 'go off'. Or as it is better known in the wine world as 'Over the Hill'.

As we all know, an increasing demand (due to increasing quality and rarity) together with a decreasing supply (due to consumption) creates the basis for a very successful and stable market.

With our panel of experts we are able to predict when specific top class wines will mature and when they will reach the end of their prime drinking life. We are able to offer structured investments, with varying degrees of risk, to mature at specific times.

Emerging Markets

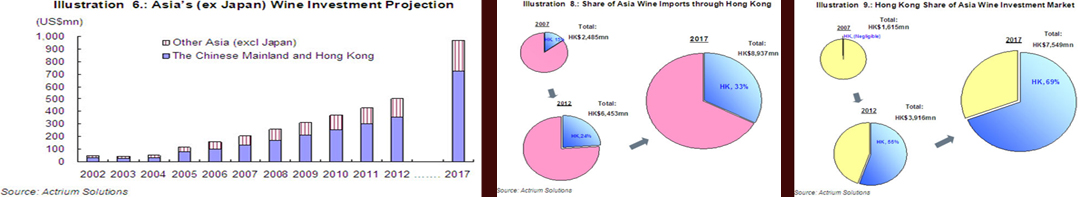

It's an Asian Wine Boom

The fine wine auction boom in Asia has hit a new high after nine consecutive Sotheby's Hong Kong fine wine auctions have been 100% sold in the last 18 months, with the vast majority of items in the last two sales exceeding their high estimates. Less than two years later, Hong Kong has become an auction hub that rivals London and New York. Five major houses now hold regular sales, and they're pulling in record prices for the hottest labels. What pushed this vibrant city into the wine big leagues was its decision to abolish all taxes on wine on Feb.27,2008.

"its a feeding frenzy, a complete fantasy now," says David Elswood, Head of international wine sale at Christie's. But Auctions are only part of Hong Kong's wine boom, Says James Miles, a Liv-ex director who grew up in the city and regards it as his home. "The retail market is 10 times larger." he says. U.K merchants used to sell some 40 percent of there stock to U.S. trade and private customers; now these sales have shifted to buyers in Hong Kong. These merchants sold $80 million of still wine to Hong Kong's five top importers in the first seven months of 2009--more than all of 2008 and nine times what was sold in 2006. China accounts for 4% of the world's total wine consumption, valued at some 7 billion. this is expected to reach 9 Billion by 2013.

Tax Deal to Uncork India for Wine Investors

When Hong Kong scrapped all taxation on alcohol sales in 2008, it sent the price of investment wine into the stratosphere. Tax cuts on wine purchases are now set to happen in India!!

The trade deal could result in India finally being opened up to the wine investment market, with a consequent leap in demand. The abolition of tax on alcohol in China in 2008 resulted in Hong Kong becoming the world’s premier wine trading hub. Last year Sotheby’s made 52pc of total sales in Hong Kong, against 16pc in New York and 32pc in London. The total value of the sales was $85.5m (£54m).

The current trade negotiations between the EU and the Indian government have been going on for four long years but – finally – a deal looks about to be struck in the coming months. This could have a dramatic impact on the global wine industry. Any deal would see India slash tariffs on imported alcohol in return for an opening-up of the European market to India.

Imported wines currently face a 150pc tariff in India as well as an “extra additional duty” of 4pc. This is before any additional taxes imposed by India’s individual states. These range from 30pc to more than 100pc and have made investing in wines relatively unattractive.

The new agreement could see import duties slashed to just 40pc, boosting the sale of investment-grade wine. Comparisons have been drawn with the situation in Hong Kong in 2008, which saw the fine wine market explode after import taxes were scrapped altogether. Like other areas of Asia, wine has hugely grown in popularity in India over the past decade, as a rapidly expanding middle and upper class scramble to get their hands on it.

Wine imports have doubled to £17.8m over the last two years and with India’s consumer markets expected to quadruple over the next two decades, the lowering of import duties could not come at a better time. There has also been some comments that a break-up of the eurozone may boost wine investments, as people scrabble to find “hard assets” to deploy their wealth.

“With this kind of potential appreciation, investors are starting to eye fine wine not just as a luxury product but also as a place to park serious money and watch it grow” Bloomberg Market Magazine