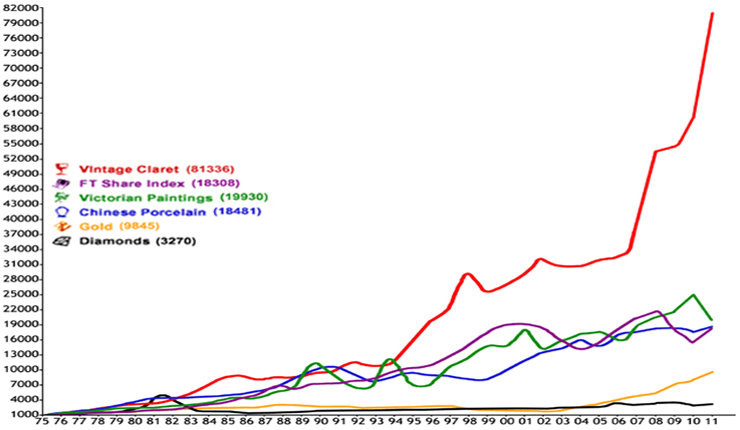

Comparative Investment Performances

Wine versus Precious Metals

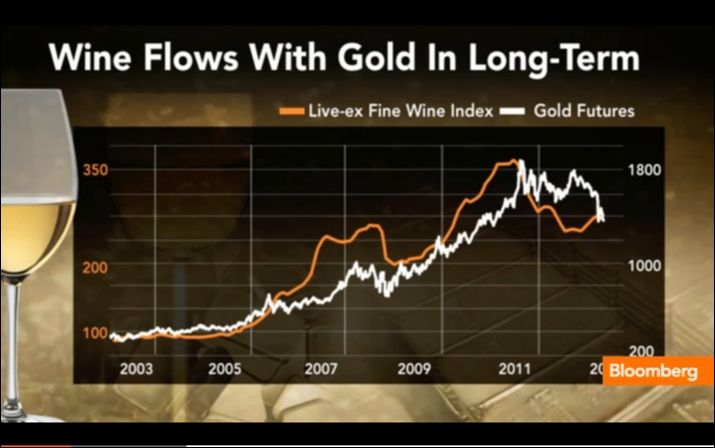

Wine versus gold – the comparison itself may be absurd to some investors, as gold is perceived to be in a whole different league than fine wine. However, Investments can come in many forms, and arguably most experienced brokers will turn you in the direction of precious metals, but what if you could hone in on your more patient side?

In the year 1833 the price of an ounce of Gold is registered at around $20, and that same nugget today is worth approximately $1670.

But why is this important?

Because, this shows that the precious metal we all know for it’s tenacious value, has appreciated over 83 times in the last 180 years. If this excites your investment organs, then perhaps paying attention to how vintage wines have come to be such a centrepiece for opportunists around the world today. For example, a single bottle of d’Yquem from Sauternes 1787, probably sold retrospectively for $100, will today fetch over $191,000.

Although undrinkable, people will always pay more for something that increases in scarcity, whether it fuels a hobby or for the sake of turning a profit over more time. Although it seems simple for one to talk about the benefits of wine investing, you should only ever deal with someone you feel you can trust and always do your homework. From the prospective of somebody who wants to invest in wine coming across a rogue could cost you everything, as some commission fees from sellers can swallow up the capital immediately.

Making the decision to invest in wine could be the greatest decision you ever make, but why does it appear to appreciate faster than precious metals? One of the main reasons is that once a bottle is tainted, opened or smashed, that’s it, it cannot be recovered and in case of any of these events unfortunately happening, others of its kind should go up in price.

This doesn’t happen with Gold for example, thus only increasing in price representative of it’s value against other commodities. Although precious metals are limited due to the impossibility of fusing the elements needed to create them, fine wines are in continuous production, the passing of time that matures their value is out of our control and can create an inevitable investment opportunity. Whether the investment is for personal or commercial intent, there is no doubt that such a commodity won’t go unnoticed to the sharpest of opportunists for centuries to come.

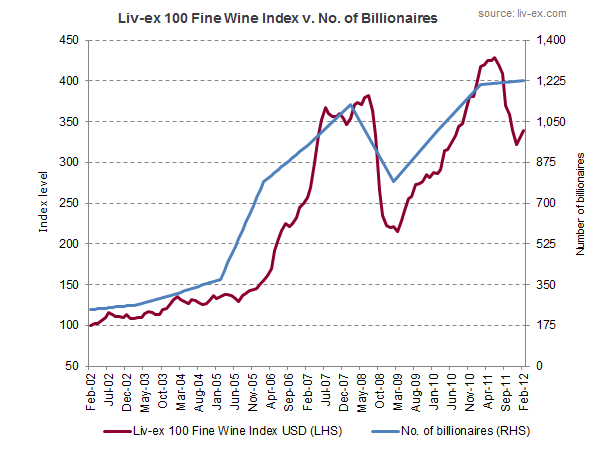

Wine Versus Billionaires

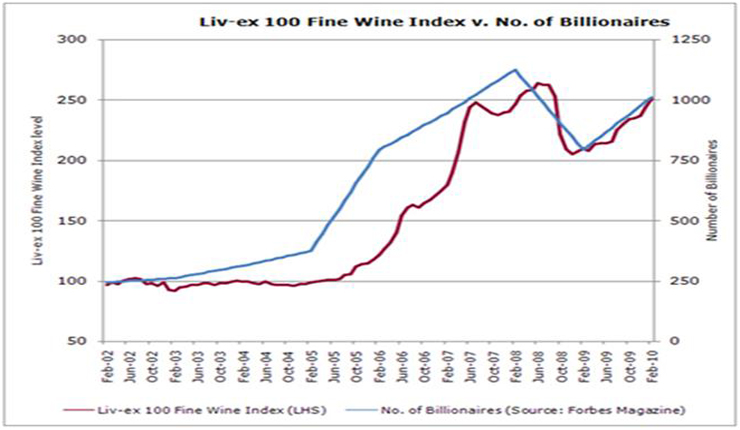

Liv-ex, the fine wine trading exchange and wine market analyst, have come up with this thought-provoking graphic, plotting the number of billionaires known to exist with their fine wine index. As you can see from the chart bellow the growth over the past 8 years between the Fine Wine Market ( Liv-ex) and the number of Billionaires (forbes.com) is almost a mirror image of each other. It is no lie that the billionaires in this world reflects massively on the performance trends of the Fine Wine Market and as the world gets richer more demand is placed on the finest wines in the world ( investment Grade Wines).

Vino Bay Assets Ltd

Kemp House

152 - 160 City Road

London, EC1V 2NX

Tel: + 44 (0) 207 411 9067

Email: info@vinobayassets.com

Website: www.vinobayassets.com

Our Blog

Here s a sobering thought for you A global wine shortage may be around the corner According to a

Read More

Currently the BRICs are seeking safe havens in SWAG assets shouldn t you be doing the same The fact is as reported in the Money Section of The Times Newspaper on the 16th June title

Read More

When Hong Kong scrapped all taxation on alcohol sales in 2008 it sent the price of investment wine into the stratosphere Tax cuts on wine purchases are now set to happen in

Read More

Robert Parker is the most influential wine journalist in the World Therefore his scores are eagerly anticipated by everyone within the wine market A good score from Robert Parker Jnr can add

Read More

Press Articles

Vino Bay Assets Ltd is a trading member of the London International Vintners Exchange better known as Liv-ex

Copyright 2009 Vino Bay Assets Limited